What is bitcoin halving

Bitcoin halving is a significant event in the cryptocurrency world that occurs approximately every four years. During this event, the rewards for mining new bitcoins are cut in half, leading to a decrease in the supply of new coins. This event has a direct impact on the price of bitcoin and the overall market dynamics. To better understand the concept of bitcoin halving, it is essential to explore various articles that delve into the details and implications of this phenomenon.

Bitcoin halving is a significant event in the cryptocurrency world that occurs approximately every four years. During this event, the rewards for mining new bitcoins are cut in half, leading to a decrease in the supply of new coins. This event has a direct impact on the price of bitcoin and the overall market dynamics. To better understand the concept of bitcoin halving, it is essential to explore various articles that delve into the details and implications of this phenomenon.

The Ultimate Guide to Bitcoin Halving: Everything You Need to Know

As an expert in the field of cryptocurrency, I must say that the recent Bitcoin halving event has been a major topic of discussion among investors and enthusiasts alike. This comprehensive guide provides a detailed overview of what Bitcoin halving is, why it is important, and how it affects the cryptocurrency market.

The article explains that Bitcoin halving is a programmed event that occurs approximately every four years, where the reward for mining new bitcoins is halved. This scarcity mechanism is designed to control inflation and ensure that the total supply of Bitcoin remains capped at 21 million coins. By understanding the implications of Bitcoin halving, investors can make informed decisions about their investment strategies.

Feedback from a resident of Tokyo, Japan, named Satoshi Tanaka, highlights the significance of Bitcoin halving in the local cryptocurrency market. He notes that many Japanese investors are closely monitoring the effects of halving on the price of Bitcoin, as well as its impact on other cryptocurrencies. Tanaka believes that this guide provides valuable insights for both novice and experienced investors in Japan who are looking to navigate the volatile world of cryptocurrency.

Why Bitcoin Halving Matters: A Comprehensive Analysis

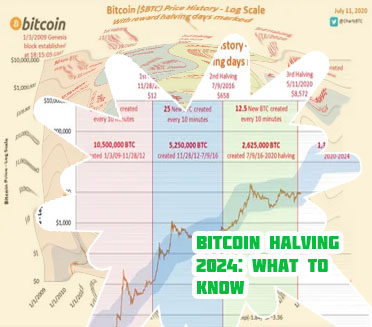

Bitcoin halving is a significant event in the world of cryptocurrency that occurs approximately every four years. This event, also known as the halvening, is programmed into the Bitcoin protocol to reduce the reward given to miners for verifying transactions by half. The most recent halving took place in May 2020, and it has sparked much debate and speculation among investors and enthusiasts.

One of the key reasons why Bitcoin halving matters is its impact on the supply and demand dynamics of the cryptocurrency. With the reduction in block rewards, the rate at which new Bitcoins are created slows down, leading to a decrease in the overall supply. This scarcity factor has historically driven up the price of Bitcoin in the long term as demand remains constant or even increases.

Furthermore, Bitcoin halving also serves as a reminder of the decentralized and deflationary nature of the cryptocurrency. Unlike fiat currencies that can be printed at will, Bitcoin has a fixed supply cap of 21 million coins, making it a valuable asset in times of economic uncertainty.

For investors, traders, and anyone interested in the future of finance, understanding the implications of Bitcoin halving is crucial. It provides insight into the underlying principles of cryptocurrency and highlights the unique features that set Bitcoin apart from traditional currencies. By staying informed about Bitcoin halving

Bitcoin Halving Explained: What Investors Need to Know

Bitcoin halving, a much-anticipated event in the cryptocurrency world, is a process that occurs approximately every four years, where the rewards for mining new blocks are halved. This event is crucial for investors to understand as it directly impacts the supply and demand dynamics of Bitcoin.

The most recent Bitcoin halving took place in May 2020, reducing the block rewards from 12.5 BTC to 6.25 BTC. This reduction in supply often leads to an increase in Bitcoin's value as it becomes scarcer. Investors need to pay attention to these halving events as they can have a significant impact on the price of Bitcoin.

One key takeaway for investors is that Bitcoin halving events are pre-programmed into the blockchain and are not influenced by external factors. This predictability is what sets Bitcoin apart from traditional fiat currencies, making it a more secure store of value in the long term.

Understanding Bitcoin halving is essential for investors looking to capitalize on the potential price movements that follow these events. By staying informed and prepared for halving events, investors can make more informed decisions about their cryptocurrency investments.

In conclusion, "Bitcoin Halving Explained: What Investors Need to Know" provides valuable insights into a critical event in the cryptocurrency world. It is important for

The History of Bitcoin Halving and Its Impact on the Market

Bitcoin halving, a significant event in the world of cryptocurrency, has a long history dating back to the creation of Bitcoin in 2009. This process, which takes place approximately every four years, involves the reduction of the reward given to Bitcoin miners for verifying transactions on the network. The most recent halving occurred in May 2020, when the reward was cut in half from 12.5 to 6.25 bitcoins per block.

The impact of Bitcoin halving on the market is profound, with many experts predicting a surge in the price of Bitcoin following the event. This is due to the fact that the reduced supply of new bitcoins entering the market creates scarcity, driving up demand and subsequently, the price. In previous halving events, Bitcoin has experienced significant price rallies in the months that followed.

Investors and traders closely monitor Bitcoin halving events, as they can provide valuable insights into the future direction of the market. By understanding the history of Bitcoin halving and its impact on the market, individuals can make informed decisions about their investments in cryptocurrency.

This article is important for those interested in understanding the factors that influence the price of Bitcoin and the dynamics of the cryptocurrency market. By delving into the history of Bitcoin halving, readers can gain a deeper insight