Cryptocurrency price

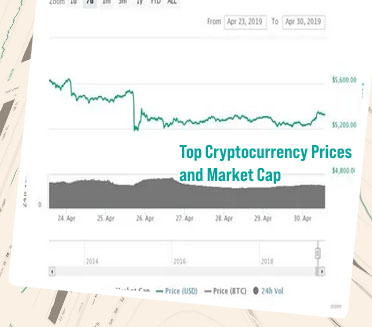

Cryptocurrency prices can be volatile and unpredictable, making it challenging for investors to make informed decisions. However, by staying informed and understanding the factors that influence cryptocurrency prices, investors can better navigate this market. To help you in this journey, we have curated a list of two articles that will provide insights and strategies for analyzing and predicting cryptocurrency prices.

Cryptocurrency prices are constantly fluctuating, making it a challenge for investors to predict their movements. To help navigate this volatile market, we have curated a list of two articles that provide valuable insights and strategies for understanding and managing cryptocurrency prices effectively.

The Ultimate Guide to Analyzing Cryptocurrency Price Trends

Cryptocurrency price trends have become a focal point for many investors seeking to capitalize on the volatile nature of digital assets. Understanding how to analyze these trends is crucial for making informed investment decisions in the ever-changing world of cryptocurrency. In "The Ultimate Guide to Analyzing Cryptocurrency Price Trends," readers are provided with a comprehensive overview of the various tools and techniques used to track and interpret price movements in the world of digital currencies.

The guide covers a wide range of topics, including technical analysis, fundamental analysis, and sentiment analysis. Technical analysis involves studying historical price data and chart patterns to predict future price movements. Fundamental analysis, on the other hand, focuses on evaluating the intrinsic value of a cryptocurrency based on factors such as technology, team, and market demand. Sentiment analysis involves gauging market sentiment through social media and news sources to anticipate price trends.

Overall, this guide is a valuable resource for both novice and experienced cryptocurrency investors looking to gain a deeper understanding of how to interpret price trends in the market. By mastering the techniques outlined in this guide, investors can make more informed decisions and potentially increase their chances of success in the world of cryptocurrency trading.

Recommendations:

- Consider including case studies or real-life examples to further illustrate the concepts discussed in the guide.

- Explore

Strategies for Safely Investing in Cryptocurrency During Price Volatility

Cryptocurrency has become a popular investment option in recent years, with many investors attracted to the potential for high returns. However, the volatile nature of the market can make it challenging to navigate. To safely invest in cryptocurrency during price volatility, it is essential to have a well-thought-out strategy in place.

-

Diversify your portfolio: One way to mitigate risk in the cryptocurrency market is to diversify your investments. By spreading your funds across different cryptocurrencies, you can reduce the impact of price fluctuations on any single asset.

-

Set stop-loss orders: Setting stop-loss orders can help protect your investment from sudden price drops. This automated trading strategy allows you to set a predetermined price at which your assets will be sold, limiting potential losses.

-

Stay informed: Stay up to date with the latest news and developments in the cryptocurrency market. By staying informed, you can make more informed investment decisions and better navigate price volatility.

-

Use dollar-cost averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the asset's price. This strategy can help smooth out the impact of price fluctuations over time.

-

Consider long-term investment: Instead of trying to time the market, consider a long-term investment strategy. By holding onto your assets